Experian is a comprehensive financial management application that empowers users to take control of their credit health. The app provides free access to your Experian credit report and FICO® Score, enabling you to monitor your credit standing without impacting your score. With features like Experian Boost®, users can potentially improve their credit scores by incorporating regular bill payments such as utilities and streaming services.

In addition to credit monitoring, the app offers marketplace comparisons for credit cards, personal loans, and car insurance tailored to individual credit profiles. For those seeking premium benefits, Experian provides services like Bill Negotiation & Subscription Cancellation and Experian CreditLock, which help protect against identity theft and save on monthly expenses. These tools collectively ensure users are well-equipped to manage their financial future confidently.

Experian stands out with its robust set of features designed to enhance user's financial literacy and security. One of the key functionalities includes real-time credit monitoring, which alerts users to significant changes in their credit profile, such as new account openings or inquiries. This proactive approach helps users quickly address potential issues.

The app also includes Experian Boost, allowing users to potentially increase their FICO® Scores by considering utility, phone, and streaming service payments. Furthermore, the Marketplace feature provides personalized financial product recommendations, ensuring users find the best rates and deals based on their creditworthiness. Premium subscribers benefit from additional services like Bill Negotiation and CreditLock, offering both savings and enhanced protection against fraud.

User-friendly interface

Free credit monitoring

Comprehensive credit reports

Personalized financial insights

Identity theft protection

Premium features require subscription

Limited boost eligibility

Varied negotiation success

Not all lenders use Experian

Regional service limitations

Bitcoin gpu app helps you remote mine using your cell phone easily .

3.60

3.60

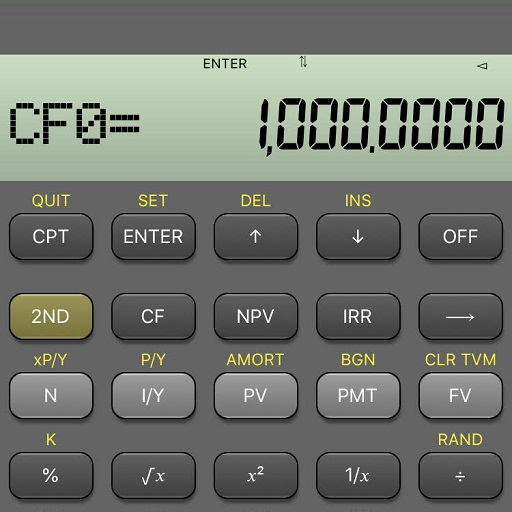

BA Financial Calculator PRO – Perfect for CFA/FRM/CPA and finance professionals

4.90

4.90

Get a cash advance instantly. File taxes & cover unexpected bills in minutes.

4.60

4.60

The simplest way to budget, bank, save and invest.

4.50

4.50

Payday cash advance & Instant cash advance: Borrow money instantly, Get cash now

4.60

4.60

Invest, bank & save in one app. Trade stocks, earn high APY & budget smarter.

4.00

4.00

Get up to 500, get paid early, earn interest and find work with no hidden fees.

4.40

4.40

Currency Converter (200+ currencies) with live exchange rates and offline mode.

4.70

4.70

Bill pay, card lock, check deposit and more - all on the Capital One Mobile app.

4.50

4.50

No credit checked needed.

4.80

4.80

No credit check, no interest, no worries.

4.70

4.70

“Money Manager” is an optimized application for personal asset management.

4.70

4.70

Easily invest, save, and plan—all in one app.

4.60

4.60

Banking, Budgeting & Investing

4.60

4.60

Real-time tracking: Stocks, Indices, Futures, Commodities, ETF, & Funds prices.

4.60

4.60

Earn cash & save money daily. Access instant cash advances* - no credit check!

4.50

4.50

Trade NFL, NBA, Crypto, Tech

4.50

4.50

Expenses, Bills, Budget and Accounts - All seamlessly integrated in one app!

3.80

3.80

Secure Amex Account Access: View Balance, Make Payments, Redeem Rewards & more

3.60

3.60

User Reveiws