Varo Bank represents a new era of digital banking, offering a comprehensive suite of financial services through its mobile application. As a legitimate bank operating in the digital space, Varo provides users with essential banking features such as early direct deposit, high-interest savings accounts, and credit-building tools. The app stands out by integrating advanced functionalities like automatic cashback rewards, instant cash advances, and personal lines of credit, all designed to enhance user convenience and financial health.

The app is particularly beneficial for individuals seeking a modern banking solution that combines traditional banking security with innovative digital tools. With no hidden fees, free ATM withdrawals at over 40,000 locations, and complimentary credit score monitoring, Varo Bank ensures accessibility and transparency. Its unique offerings, including a high yield savings account and secured credit card for credit building, cater to users aiming to improve their financial standing while enjoying the perks of digital banking.

Varo Bank's feature set is meticulously crafted to meet the diverse needs of today's digital consumers. The app offers an impressive range of tools, starting with its high-yield savings account that provides up to 5.00% APY on balances up to $5,000, significantly higher than traditional banks. This feature alone makes it an attractive option for savers looking to maximize their returns without additional risk.

Beyond savings, Varo includes robust credit-building mechanisms through its secured credit card, which requires no credit check or annual fees. Users can also take advantage of instant cash advances ranging from $20 to $500, once qualified, alongside a personal line of credit with flexible repayment terms. These features collectively empower users to manage their finances effectively, build credit responsibly, and access funds when needed, all within a secure and user-friendly environment.

User-friendly interface

High-interest rates

No hidden fees

Early direct deposit

Free credit monitoring

Limited branch access

Qualification requirements

Geographic restrictions

Fees for some services

Credit limits apply

The DailyPay app lets you access earned wages before your next payday.

4.70

4.70

Manage your prepaid cards and add to Google or Samsung Wallet.

4.60

4.60

Debt pay off. Build credit history. AI budget tool. Loan offers.

4.60

4.60

Retirement plan, IRA, retail and HSA customers serviced by Empower.

3.10

3.10

Save, spend & get paid faster²

4.50

4.50

Manage your credit card account with the Credit One Bank mobile app.

4.70

4.70

Currency Converter (200+ currencies) with live exchange rates and offline mode.

4.70

4.70

The US Debt Clock .org App gives you a Real-Time glimpse of US Financial Stats

4.60

4.60

Trade NFL, NBA, Crypto, Tech

4.50

4.50

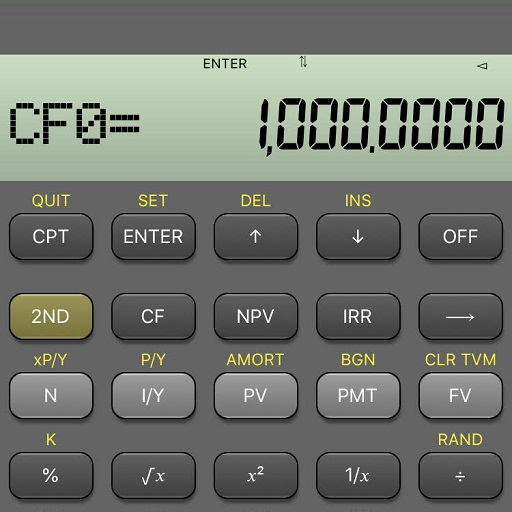

BA Financial Calculator PRO – Perfect for CFA/FRM/CPA and finance professionals

4.90

4.90

Simple & secure international money transfers - for personal & business needs.

4.80

4.80

Easy budgeting planning on a calendar!

4.80

4.80

Join 12M+ users. Instant cash advances, personal loans, build credit, save money

4.80

4.80

Your Big Financial Friend

4.70

4.70

Cash Advance, Credit Cards, Credit Lines, Score Monitoring, Saving, Budgeting

4.70

4.70

Play for fun, earn for real. Collect rent by owning virtual land & get cashback

4.60

4.60

All your crypto & stocks in one secure and trusted app.

4.40

4.40

Venmo is the fun and easy way to pay and get paid.

4.10

4.10

View BSC Transactions for multiple accounts

3.90

3.90

User Reveiws